Hedge Fund

Features

- Selection of excellent funds by those who have many years of experience in hedge fund product development (selection / monitoring)

- Investment in world-renowned hedge funds can be purchased from 10 million yen by using the affiliated overseas access platform

- If there is a certain demand, we also provide a service to invest in a hedge fund nominated by the customer or to build a dedicated hedge fund portfolio that meets the customer investment needs.

- After submitting a notification to the Financial Services Agency, we will provide product explanations and regular reporting services in Japanese.

Scheme image

Fund Business Introduction

US Multi-Strategy Hedge Fund Example A

(Market Neutral, US Dollar Denominated)

(Market Neutral, US Dollar Denominated)

Features

- Aim for performance that is not easily affected by the financial market environment through a diversified investment strategy.

- Has a track record of over 30 years of operation.

- Emphasis on controlling monthly win rate and monthly loss rather than monthly absolute profit.

Fund returns / risks

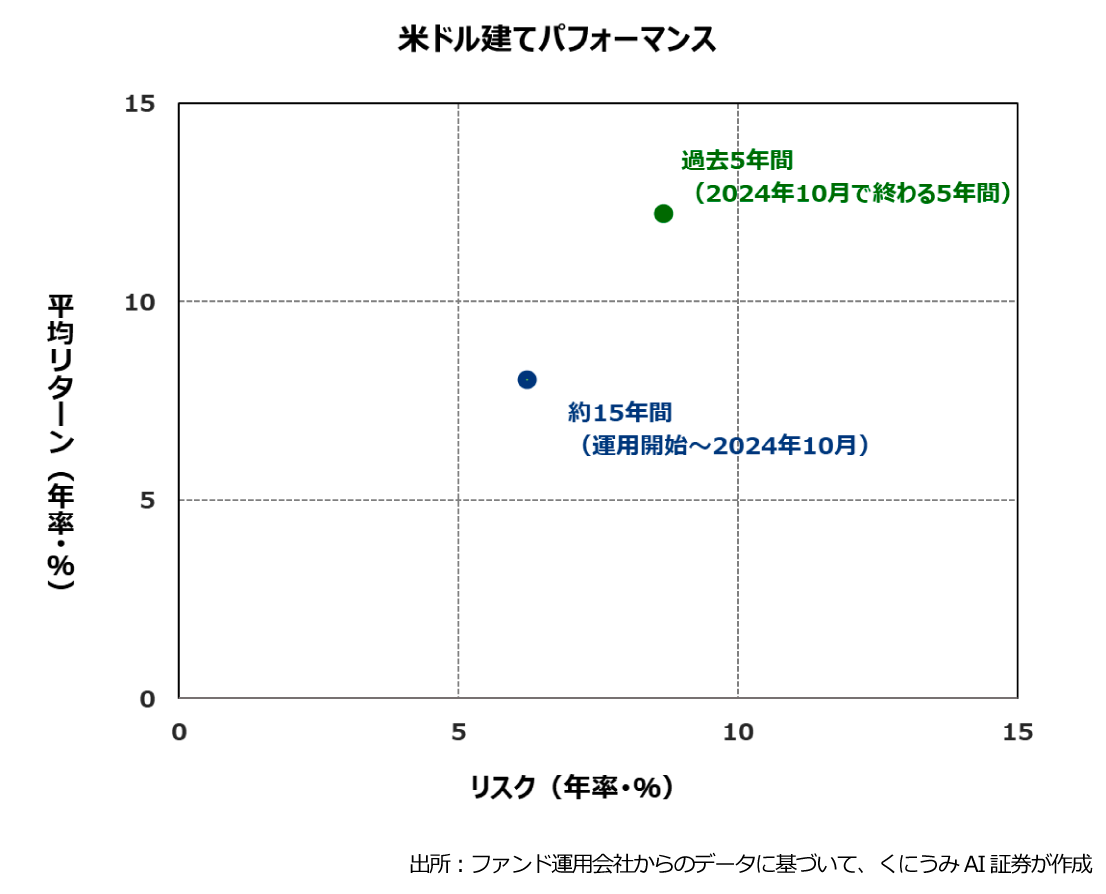

Long Bias Equity Long/Short Hedge Fund Example

(US Dollar Denominated)

(US Dollar Denominated)

Features

- Long/short strategy of long bias targeting emerging companies (startups) in developed countries by major global managers.

- Focus on companies that are less dependent on financing and have cash flow generation capacity, and invest in stocks of companies (regardless of capital size) in the early stages of the business life cycle.

- An investment strategy that has resistance to declines in addition to the medium- to long-term upward potentialof stock prices.

Fund returns / risks

US Event Driven Hedge Fund Example

(US Dollar Denominated)

(US Dollar Denominated)

Features

- An event-driven fund managed by a globally influential activist.Operation results for about 25 years.

- A fund that creates its own catalyst in investing in listed stocks, corporate bonds, private stocks, etc. by being actively involved in corporate management.

- Aim to achieve attractive risk-adjusted returns by seizing opportunities.

Fund returns / risks

US Multi-Strategy Hedge Fund Example B

(Market Neutral, US Dollar Denominated)

(Market Neutral, US Dollar Denominated)

Features

- Operational performance that has survived the "multi-phase financial and economic cycle" of about 30 years

- Aim for market-neutral investment returns by diversifying investment strategies, investment teams, and investment target assets

- The operational philosophy that the combination of humans, machines (Artificial Intelligence, etc.), and data is the future image of investment

- Investment strategies include equity long /short, systematic trading, global macro, etc.

- Stabilize investment performance through advanced risk management

Fund returns / risks

Fund of Multi-Strategy Hedge Funds

(US Dollar Denominated)

(US Dollar Denominated)

Features

- Concentrated investment by allocating funds equally to multi-strategy funds of three asset management companies

- Offers a unique opportunity to invest in three multi-strategy hedge funds in a diversified manner

- Aim for absolute return while limiting risk by further diversifying investment strategies and selecting strategies to prioritize

- With the cooperation of overseas affiliated asset management companies, we can quickly change the funds to be incorporated in response to changes in the fund acceptance status and investment status of the incorporated funds

Fund returns / risks

Bio & Medical Technology Investment Equity Long/Short Fund

(US Dollar Denominated)

(US Dollar Denominated)

Features

- Strategy aiming for long-term stable returns in “healthcare investment” where the market movement cycle is significant

- Targeting mainly small and mid-cap companies, explore growth potential that is not fully reflected in the market while suppressing downside risk

- An asset management company specializing in healthcare based on the East Coast of the United States

- Building a portfolio that focuses on innovative fields across the life sciences, including biotechnology, medical technology, diagnostics, and genome science

- Use short positions made from custom-made stock baskets to limit downside risk, and pursue individual company-specific growth based on long positions

Fund returns / risks

Niche Investment Multi-Strategy Hedge Fund Example C

(US Dollar Denominated)

(US Dollar Denominated)

Features

- Pursue investment returns by focusing on niche strategies and nimble capital allocation

- Aims for low correlation with the market and other large multi-strategy funds

- Thorough risk management helps to minimize downside volatility

- Investment management by a large number of teams of specialists focused on a wide range of niche strategies

Fund returns / risks

Litigation Finance Strategy Example with low correlation to equity markets

(US/JPY Denominated)

(US/JPY Denominated)

Features

- An investment strategy that involves lending funds to UK law firms and other entities for the purpose of receiving interest and litigation success fees

- Open-Ended Fund

- In principle, loans are made as recourse loans (asset joint ownership, etc.)

- Build a portfolio that is diversified by types of litigation, law firms, and litigation timing

- US dollar denominated/Japanese yen denominated

Event Driven Credit Fund Example

(US Dollar/Japanese Yen Denominated)

(US Dollar/Japanese Yen Denominated)

Features

- Explore special situation investment opportunities in global credit markets, focusing on bonds and loans

- Pursuing investment returns that stem from company-specific special factors

- Dynamic allocation of funds to multiple special situation strategies

- Emphasis on risk control (consideration of collateral value, implementation of short positions, etc.) to suppress downside risk

Fund returns / risks

Contact

Alternative Investment Products Department

TEL:03-5288-6827